What research does EngineeringUK do?

For over 20 years, our work has included a programme of comprehensive research into engineering and technology in the UK. We look at the industry and workforce, the talent pool and skills needs and future workforce projections. We also analyse STEM careers provision in education and survey young people and their influencers, to understand their views of engineering and tech careers.

Who works in engineering and technology in the UK?

We look at the roles and sectors that make up the industry, plus the people in them. Regularly reviewing key data helps to identify trends, understand how engineering and tech is developing and how representative the workforce is. We regularly assess skills needs and future workforce projections, especially in relation to net zero targets.

Explore industry and workforce

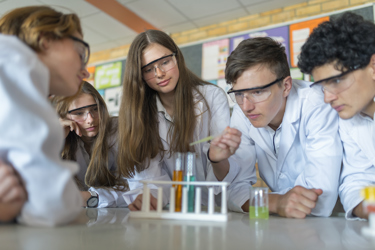

Do students get good STEM careers advice?

We want all young people to get accurate, up-to-date STEM careers information so they are supported to make informed careers decisions. Our research looks at STEM careers provision in education, looking at current arrangements, regional differences, trends and challenges and make recommendations for change.

What does evaluation tell us?

Understanding the effectiveness of outreach activity helps us to develop and refine engagement activities, so they really make a difference. We evaluate our school programmes and review wider evidence to understand what works well in inspiring the next generation.

What do young people think?

What do school students think about careers in engineering and tech? Or about STEM in school? Our research tries to understand the attitudes and perceptions of young people and the people who influence them – teachers and parents. We look at trends within different groups, particularly by gender.

What do STEM teachers think?

What route would teachers recommend for a career in engineering and technology? How do they find quality STEM outreach? And how often can they do it with their students? What barriers do teachers face if they want to do science practicals? What are the challenges in recruiting and retaining STEM teachers? Our research tries to understand the knowledge and perceptions of STEM teachers, and get an insight into the challenges they face in schools today.

How does EngineeringUK conduct research?

We conduct our own primary research and analysis. We use different methodologies depending on the type of research and include details of these in our reports. We also do secondary research and secondary analysis from available datasets. We often work in partnership as well as commissioning research.

Subscribe to our newsletter

Get the latest news, views, research and updates direct to your inbox each month.